Renters Insurance in and around Greenwood

Looking for renters insurance in Greenwood?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Greenwood Renters!

Trying to sift through providers and deductibles on top of your pickleball league, work and keeping up with friends, is a lot to deal with. But your belongings in your rented apartment may need the incredible coverage that State Farm provides. So when the unexpected happens, your sound equipment, sports equipment and videogame systems have protection.

Looking for renters insurance in Greenwood?

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renters insurance may seem like last on your list of priorities, and you're wondering if having it is actually beneficial. But imagine how much it would cost to replace all the belongings in your rented space. State Farm's Renters insurance can help when thefts or accidents damage your personal property.

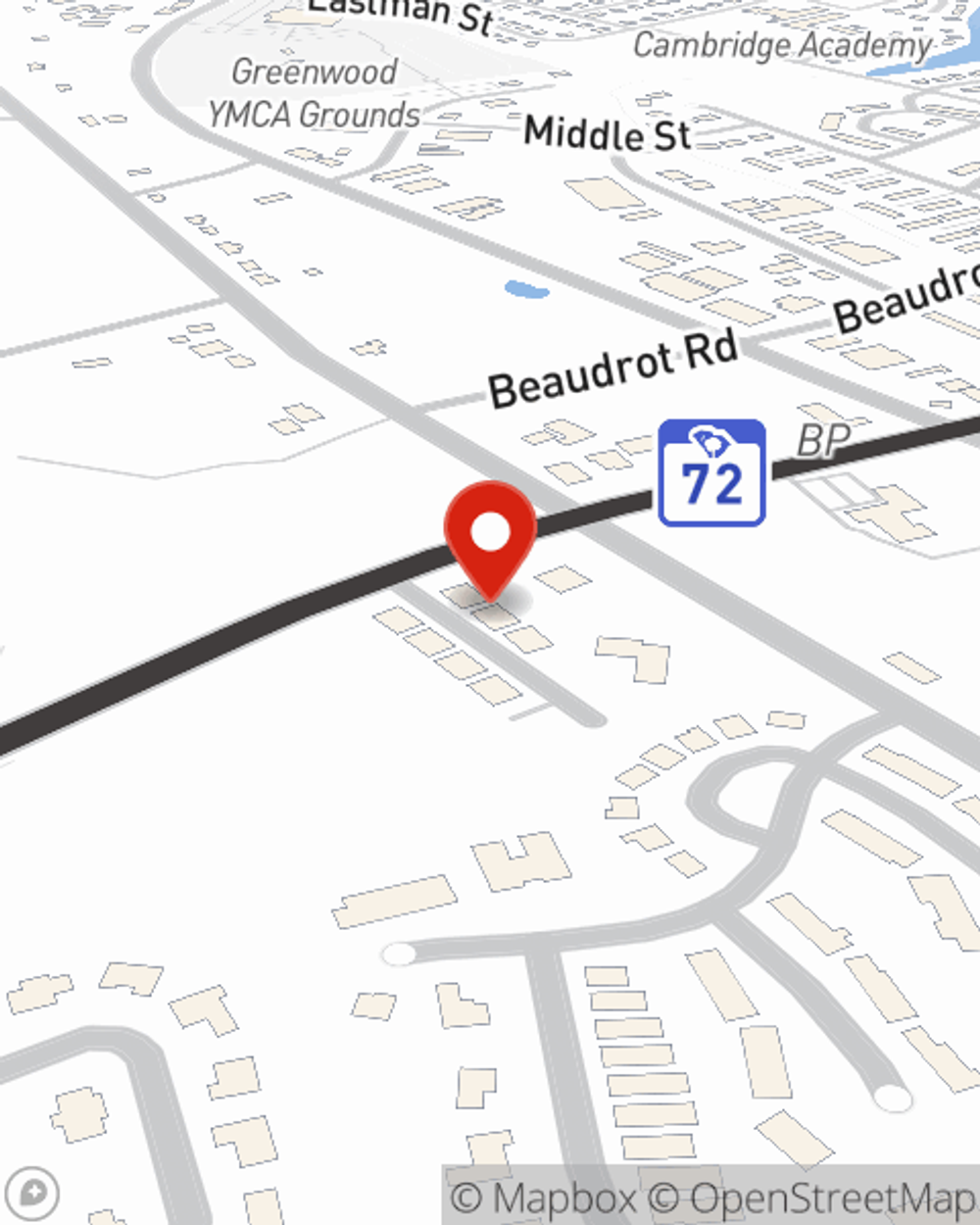

If you're looking for a value-driven provider that can help you understand your options, call or email State Farm agent Bobby Patterson today.

Have More Questions About Renters Insurance?

Call Bobby at (864) 450-9690 or visit our FAQ page.

Simple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Bobby Patterson

State Farm® Insurance AgentSimple Insights®

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.